This Program is your gateway to a successful career in accounting and finance. Unique to The Career Academy, this Program is designed for ambitious individuals who want to advance to the top of the accounting profession. By enrolling in this program, you not only gain invaluable knowledge and skills, but also the unique advantage of becoming a qualified accountant and member of ACCA. The ACCA Qualification gives you the most up-to-date skills you need to become a finance professional.

*Exams are exempt from the price of this product, an Additional £1200 is required to partake in the 10 exams

Get instant access

Plus receive unlimited tutor support via phone & email from experienced professionals.

Improve your accounting career

Be awarded with an industry-recognised certificate of achievement on completion of this course.

Improve your career prospects from just £25 per week.

By completing this course, you will be on your way to becoming an ACCA member, after finishing the 10 Exams, an online EPSM module, and the Professional Bodies standard of 36 months experience, you’ll be recognised as a financial expert with highly sought after professional skills and ethical values. ACCA Membership give access to…

At The Career Academy, we understand the importance of thorough preparation and continuous professional growth for ACCA students. That’s why we’re proud to offer a comprehensive suite of free ACCA resources, meticulously designed to support your journey from the classroom to the boardroom.

Held four times a year, with options to sit at a test centre or remotely.

Recommended before Strategic Professional Exams.

36 months of supervised experience in a relevant role.

Access a full Syllabus, short quizzes, and flash cards to help prepare you for your exams

Track your performance, with these support tools to help set, assign, and mark practice content

Engage with our dynamic multimedia content for insightful learning on the go.

Your personal study planner, guiding you through your ACCA journey with customized study schedules.

The Diploma in Accounting includes learning across basic, advanced, management, and taxation accounting – plus, you will enhance your task management abilities and undertake an accounting skill assessment. View the modules below.

Students will develop knowledge and skills relating to the tax system as applicable to individuals, single companies and groups of companies.

The Career Academy will cover your first years subscription (you’ll be required to pay in subsequence years). To become a full member of the ACCA, you will need to finance the costs of your exams and EPSM fees at an additional cost of £1,731 (paid to ACCA) upon completion of this course.

*Note that Chartered Certified Accountant is a different certification to a Chartered AccountantRegistration Fee

Exemption Fee x3

1st year subscription to ACCA Membership

£142

£142

£142

£142

£142

£142

£185

£185

Whether you prefer to pay upfront, weekly, fortnightly, or even monthly, we’ve got you covered. With our flexible payment options, you’ll have the freedom to choose the payment frequency that works best for you. No matter your budget or schedule, we’re here to make education affordable and accessible for you.

Pay Upfront & Save

Unlock savings when you pay your course fees in full

Interest FREE Payment Plan

Weekly option for budget-conscious students

per week

Total cost: £2,499 inc. VAT

We're an internationally recognised online education provider, who partners with industry to deliver you the latest and most up to date content. We have over 15 years experience in online education and help change the lives of over 20,000 students every single year.

Our professional tutors at The Career Academy are industry experts who are passionate about helping students succeed. They’re committed to providing exceptional online course support and personal tutoring to help you succeed. Throughout your course, you’ll receive unlimited tutor support via phone and email.

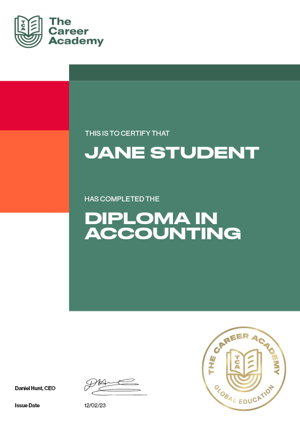

Upon successful completion of your course, you’ll be presented with a Professional Certificate by The Career Academy. This an industry recognised certificate which will go a long way to helping you get a new job or promotion. You’ll also be given access to our exclusive Career Centre and be eligible for a free CV Review.

At The Career Academy, we’re committed to providing you with the tools and resources you need for both exam success and career advancement. Join us in this journey of professional excellence with ACCA.

There are no entry requirements or prerequisites to enrol on this course. You can enrol online directly by clicking on “Enrol Now” and following the prompts.

Alternatively, you can enrol over the phone with our friendly student advisors – call

0800 112 0911 or email them at info@thecareeracademy.co.uk

This course costs £2,299 or only £25 per week on a no-deposit, interest-free payment plan. + an addition fee for the 10 ACCA exams, please contact a student advisor for a full breakdown

This course takes approximately 400 hours, and you’ll have up to 18 months to complete.

Whilst Studying you will be considered an ACCA Student.

Once you finish the 10 exams you will be an ACCA Affiliate.

After 36 months of experience working, you will become an ACCA Member.

Some students pathway onto Bachelor or Degree courses if they want to secure higher level roles in the future (i.e. CFO level). Unitec, for example, has approved credit recognition for this Diploma course into their Bachelor of Business (specifically courses ACTY5200 and ACTY5206).

Yes, you can apply for RPL for this if you already hold other accounting qualifications or have other accounting experience.

Upon completing this course, you could obtain work as an Accounting Technician. Accounting Technicians work across a wide range of finance and business, including assisting with preparing accounts, managing staff payroll, receiving and paying invoices and general bookkeeping.

Contact a friendly student advisor on 0800 342 829 to learn about potential career outcomes and where our courses could take you. You’ll also receive a FREE CV review.

Absolutely! You’ve got an 7-day cooling-off period (trial period) at the start of your course. Take that time to review all your learning material and get a feel for online learning. If you decide the course isn’t for you within the trial period, you’ll get a full money-back guarantee*.

Absolutely! Students who have complete this Program, including the CAT certification component with IPA, will also be eligible for 3 exemptions from the ACCA Qualification: